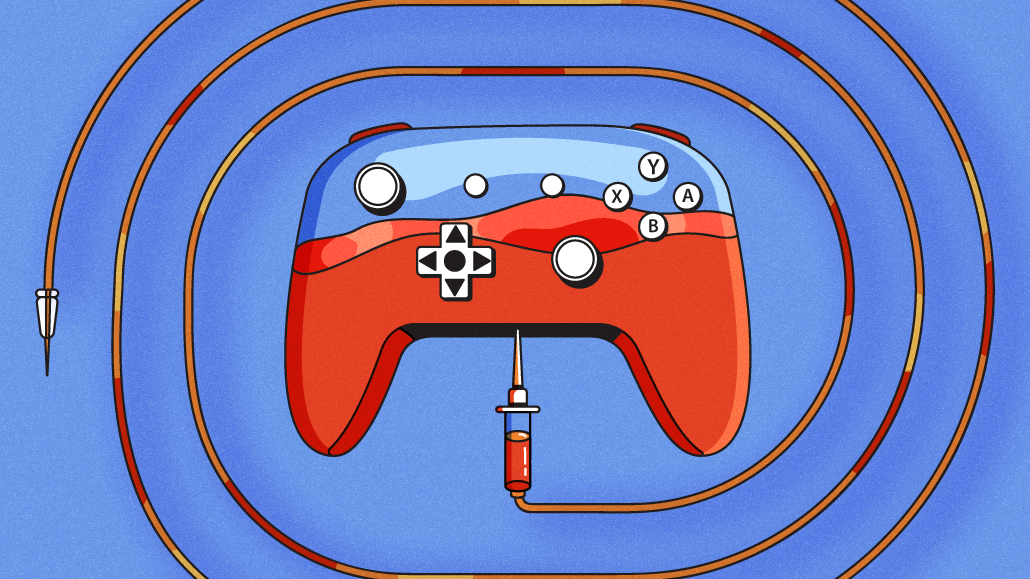

Media Buying Briefing: Can agencies help brands expand gaming and esports as women’s sports shine?

This Media Buying Briefing covers the latest in agency news and media buying for Digiday+ members and is distributed over email every Monday at 10 a.m. ET. More from the series →

Despite the growing number of women and girls in gaming, many face challenges competing in esports. But media agencies are hoping to change that while also driving more gaming content and entertainment.

Stagwell’s business-focused agency Gale and its client MilkPEP are launching a “Fortnite” tournament for women to increase participation and pay equity, Digiday has learned. The tournament — the Milk Cup — comes with a $250,000 prize, the largest in a tournament for women in North America, and includes a broader campaign featuring Twitch broadcasting, social content and forums via Discord, live discussions, and influencer collaborations.

“[We wanted to create] opportunities for women in gaming — more consistently not only for esports players, but also on the production side, like broadcasters, throughout the space,” said Ali Eng, associate creative director at Gale. “We want to create change essentially, and level the playing field.”

Although women account for almost half of the gaming community, women gamers represent only 5% of professional esports players — and there are no women in the top 500 highest earners, per Esports Earnings.

Yet esports is part of a big market with increasing opportunities across branded content, different forms of in-game advertising and influencer partnerships. In 2023, eMarketer estimated that 31.6 million esports viewers watch at least once a month, with esports ad revenue growing 10% to total $264.3 million that year, which, compared to other media, remains small. Livestreaming platform Twitch counted some 35.3 million users last year, per eMarketer.

Now, as women’s sports continue to capture audiences through college basketball (thanks in great part to Caitlin Clark’s record-smashing year) and soccer (the U.S. women’s national team has generated strong ratings for the sport in recent years), will media agencies and brands be able to channel some of that momentum in the growing esports and gaming spaces?

Gaming advertising as entertainment

With the Milk Cup on “Fortnite,” Gale and MilkPEP’s goal is to encourage women and girls in sports more widely and create greater marketing and entertainment opportunities for them in the gaming industry. In addition to partnering with gamers and influencers, the campaign associated with the event also involves an all-women broadcast team, as well as content producer RadiantGG and women’s gaming series Women of the eRena (WOTE).

The competition will be open to more than 400 women gamers, with the final battle broadcasting on Twitch. In the first 48 hours, Gale and MilkPEP said more than 200 women signed up, a 75% increase compared to previous WOTE tournaments in the first two days.

For Gale, it’s also a wider way to connect with Gen Z, which forms a big part of the gaming and “Fortnite” community.

“A big thing here at Gale is, is advertisement more as entertainment and less traditional ad,” said Eng. “We’ve seen people — kids and youth specifically — missing that kind of third place now, so we just want to create something that gives back to the community instead of just asking. I think it’s just a good place to meet people where they’re at and be a contribution instead of just an ad.”

Gale continues to expand its gaming experiments, having executed a strategic partnership last August with gaming designer Moonrock Labs to develop gaming and design for clients. It also worked with H&R Block on a “Minecraft” project and with Bomb Pop on a Roblox activation recently. Meanwhile, MilkPEP sponsored TwitchCon in 2022.

Marta Swannie, creative partner of the gaming practice at Design Bridge and Partners (two agencies that merged under WPP in 2023), said the “massive growth of the gaming industry” has pushed the agency to develop brands within the gaming ecosystem — from influencer programs and livestreams to campaigns and a variety of content across growing entertainment channels like Twitch and Discord.

“Brands [also] show up either within a game or in the wider gaming ecosystem, [like at esports events and gaming festivals], and the possibilities for brands are ever-growing,” Swannie said. “There are lots of agencies vying for a slice of the lucrative gaming pie, so it’s important for brands to work with agencies who have experience in the channel — it’s better to do nothing than to create gaming ads and entertainment that feel inauthentic or too try-hard.”

Women representation in sports and gaming

As media agencies try to expand their work in women’s sports and gaming, they say some of the obstacles include increasing representation and opportunities for women and girls in the space. Women gamers and esports professionals make less than their male counterparts, and often face harassment on the gaming platforms.

“There are so many instances of women and girls joining a team for a competition, and the guys that are on a team with them will just forfeit the game — because there’s a girl on their team,” said Jen Grubb, marketing manager of MilkPEP. “It sounds crazy, but the opportunities just are not there because the space is so toxic [with] harassment.”

Female professional esports players in the U.S. earn an average of $3.42 for every $100 earned by male players, according to a January report by Best Online Casinos.

Swannie also mentioned that focusing on diversity and representation may be a way to get more brands involved in the gaming industry, such as efforts from Dove and L’Oréal to increase diversity by creating diverse playable characters in games or gaming influencer programs to engage the community. The WPP agency also works with client Black Girl Gamers to organize virtual events like the Black Girl Gamers Online Summit that will be hosted on Twitch in June.

Influencer opportunities and beyond

Some agencies are partnering with influencers as a key way to grow in esports. In particular, gaming platforms and other immersive technologies, like virtual and augmented reality, offer new ways for creators to adapt and experiment with their content — and they “have become indispensable in gaming advertising,” said Debbie Scott-Bowden, head of gaming and esports at Wasserman, the sports marketing parent company of agency Laundry Service.

It’s also why Gale tapped female esports player and influencer Peach to be an advisor for the Milk Cup. Peach’s announcement video for the event drew 1.8 million organic views, according to Gale.

Amanie Safadi, manager of interactive media and special projects at agency Geletka+, agreed that gaming influencers are crucial to the gaming ad space — with some Twitch and YouTube streamers sponsored by major brands from Chipotle to Adobe. For example, one of the highest-earning streamers Tyler Blevins, known as Ninja, made some $10 million through his 71 million followers in 2023 with various sponsorships (including his own Red Bull can) and in-game content and deals, per Forbes.

Amazon Prime’s recent release of its series “Fallout” based on the popular video game is a good example of how “we’re in the middle of a long stretch of exceptional ad revenue growth from more traditional marketing tactics,” Safadi explained. “To the relief of Bethesda Game Studios, and their partnered agencies, the show was a hit in its first week.”

Safadi said there is already a ripple effect following this release: Not only has revenue gone up on one of the free “Fallout” games, but even one of its 15-year-old titles saw more than double its existing players on gaming service Steam.

If these trends are any indication, gaming not only has increasing potential to reach non-gaming audiences across connected TV, retail media and social — but it could become a way for agencies to bolster women’s sports and esports.

Color by numbers

As it tracks trends in media and marketing spend, GroupM’s Business Intelligence unit this June plans to shift some of the revenue YouTube declares ($31.5 billion in 2023) from the digital category (which includes social video platforms like TikTok and Reels) to its CTV category (which includes FAST platforms like PlutoTV and SAVOD services like Amazon Prime Video). The primary reason, explained global president Kate Scott-Dawkins in a newsletter last week, is “to better reflect how clients are thinking about their media allocations and alternatives.”

Scott-Dawkins cited Nielsen Gauge data from March that showed YouTube generated the highest share of any streaming provider in the U.S., at 9.7% of total day TV viewing for people 2+, compared to Netflix’s 8.1% and Hulu’s 3% — all other streamers fell below that last threshold. — Michael Bürgi

Takeoff & landing

- Omnicom announced first-quarter 2024 results, with organic growth of 4% based on gross revenue. By segment, the best performing units in organic growth were: 7.0% for Advertising & Media, 4.3% for Precision Marketing, 9.5% for Experiential, and 2.1% for Healthcare, while declines were felt in Branding & Retail Commerce (-3.8%), and Public Relations (-1.1%).

- Meanwhile, Publicis, which announced strong Q1 earnings a week prior, said shareholders approved a move to become a single-structure model, which makes CEO Arthur Sadoun also chair of the board, while longtime chair Maurice Lévy becomes chair emeritus.

- Medialink announced new management teams, split into two core advisory areas. The first, Marketing & Consulting, will be led by managing director Donna Sharp, along with md Andrea Kerr Redniss and md and chief brand officer Lena Petersen; the other unit, Media & Tech Strategy Consulting, will be led by md Christopher Vollmer, who’s overseen strategy consulting and private equity advisory services, and md’s Devrie DeMarco and Mark Wagman.

Direct quote

“I absolutely see the convergence of commerce and content, with a lot of culture in there … as we love in marketing, to do everything in three’s. You’ve got your three C’s. A lot of what we think about is, how do we tell our story, create the right content — but put it in a space where consumers can [take] action on it immediately. I think that’s a really interesting area that’s growing. … The cultural piece is paramount.”

— Molly Battin, CMO of The Home Depot, talking about new media channels at Possible 2024.

Speed reading

- I covered the news last week that independent agency group Meet the People acquired True Independent Holdings as a means to bolster its media agency prowess.

- Michael Bürgi reported on Left Off Madison’s expansion into production and live shopping content with the launch of Right Off Vine.

- Tim Peterson’s Future of TV Briefing touched on one of the biggest challenges in TV measurement, according to the Media Rating Council: how to identify audiences across media properties and channels in a privacy-safe manner.

More in Media Buying

How CTV and DOOH are growing this political season for smaller agencies

Connected TV and digital out-of-home are playing a bigger role in upcoming elections and politics – especially for smaller agencies looking to place clients’ dollars.

How companies can avoid creating an accidental manager: The Return podcast, season 3, episode 2

Just because you are good at a particular skill doesn’t mean that you would make a good manager. So, why is that the standard career path?

MediaMath has signed dozens of SSPs, including former short-changed creditors, after ad tech’s biggest bankruptcy

Trading partners such as Magnite, PubMatic, and Index Exchange have returned as part of the DSP’s relaunch under the Infillion banner.